Hayman Capital’s Kyle Bass targets U.S. pharma

In

Michael Lewis’s book ”Boomerang” from 2011 you said your largest positions were

negative positions in France and Japan. About four years later – is that still

the case?

– Japan is still the largest position. France is not.

What has

changed in France?

– Draghi’s ”whatever it takes”-speech in 2012 delayed problems with the

Eurozone for a long time. And now I think within a week or so, you’ll see the

Eurozone enter some sort of QE-program where they outright buy sovereign bonds.

I still believe the Eurozone experiment is destined to fail at some point in

time. It’s just that it may take a long time from now.

You’ve

been predicting a bond crisis in Japan for some time. Does that case still hold

up?

– What I think many have missed about the predictions is that I’ve said that there

are two valves: one is interest rates, one is currency. We’ve put about 75 per

cent of our money towards currency and 25 per cent towards rates, so on a net

basis we’ve done really well in Japan over the last three years.

At the

Texas Investor Summit in February you predicted the yen, then at around 102,

would go above 115 against the dollar during 2014. It ended the year at 119.

Where do you see the yen going during 2015?

– I think it will go north of 140. And you could see a disorderly move in the yen

this year.

But

yields in Japan have been falling to record lows. Why is that?

– The Japanese preliminary budget has Japan running a fiscal deficit of about

37 trillion yen which, if that holds, would be one of their smallest deficits

in years. But their central bank is still going to print 80 trillion yen. That

means that they’re going to buy every bond that they issue, monetizing all of

that, and then they’re going to buy about 40 trillion yen more of bonds, stocks

and Japanese REITs. Since they buy more than they issue, they are basically

taking JGB supply out of the market. That’s why you have the 5 year rate at one

basis point and the 10 year rate at around 30 points.

Could the

weaker yen spill over to the bond market?

– It hasn’t yet. The Bank of Japan is buying every bond out there, as someone

like Paul Krugman would suggest. But if you follow that hypothesis and you’re

rational about it, then one would think you would never need to have a balanced

budget. You could spend as much as you wanted to spend and your central bank

could buy every bond that the treasury issues. Well, that’s a world of fantasy.

Why would anyone ever worry about a fiscal deficit ever again if that were to

be true? At some point in time the pressure cooker breaks. Right now the

currency has been the valve that has moved, so I think the currency keeps

moving. But if you get a disorderly movement in the currency you could see a

move in rates, you could see a panic. But maybe they don’t get that. Maybe the

currency just goes from 120 to 300 or 400. Who knows where it goes.

You made

money being early in buying Greek credit default swaps a few years ago. Now

Greece is on the agenda once again with the upcoming elections. How do you see

the events unfold?

– It’s so much harder to call now, but I

think the most likely outcome is that the radicals win the election and that

they become a little less radical once they win. You can run on a political platform

until reality hits you. They would realize what would happen if Greece were to

be pushed out. The country would go broke overnight. The official sector debt,

from the IMF, the EU and the ECB, is still around 150-160 per cent of GDP. It

needs to be written down. The lenders knew that wouldn’t be repaid. They were

just buying time for the Euro zone, and probably rightly so. But in the end

those loans are going to be written down, the question is just when and how.

How do Germany, the EU and the EMU think about that? Germany has been posturing

to try to keep contagion from spreading if there is a write-down.

At the Texas

Investor Summit you were bullish on Argentina. Are you still?

– Yes, very. Argentina only has 33

per cent debt to GDP and only 15 per cent of that is externally held. They

spend about 1 per cent of GDP on interest and have both a willingness and

capacity to pay. Argentina is also a very resource rich country; it’s just a

country with a management team that is not so good. They will hold the

presidential election in October, so you’ll have a new regime, and I also think

they’ll have to settle the case with the vulture funds sometime in the next few

months.

You also

mentioned hydrocarbons.

– Argentina’s problem, if you look at their balance of payments, is energy

imports. Energy prices coming down are therefore very good for Argentina. They

have also found one of the largest shale deposits in the world in the Vaca

Muerta region. If you get a new regime in place that respects the rule of law a

little more, and is more pro-business, they’ll have foreign direct investment

flying in to the Vaca Muerta region over the next ten years. Imagine a world,

in which they have settled the case with the holdouts, they have foreign direct

investment coming in to a resource rich country – where do you think their bond

yields go? Today they’re at 12 per cent. I can imagine them at 5-7 per cent in

the world I just described. If they go to 7 per cent, that’s more than 40 per

cent returns on the bonds. It is one of our biggest positions.

But I

suppose there’s a political risk if they elect a leftist president that’s not

so pro-business?

– Further left than Cristina Kirchner? We have a saying in our office: you

can’t break your arm jumping out of the basement. There are three candidates

and they are all much closer to the center than Kirchner.

Do you

have any equity positions in Argentina?

– We own the national energy company, YPF. It serves us two purposes. One, it

serves a proxy for the Argentinean equity market. Two, it controls the Vaca

Muerta region. So the foreign direct investment will be joint ventures between

YPF and foreign oil companies.

Any other

equities you are long?

– Our portfolio is still very long. We hold positions in mortgage servicing

companies in the U.S. for example. Our biggest position in the equity book is

General Motors.

What do

you like about GM?

– First they have restructured the company. It’s a much leaner, meaner version

of its prior self. It trades at around 2,3 times its enterprise value to EBITDA. Where else can you buy a company with a 3,5 per

cent dividend yield at 2-2,5 times EBITDA? It’s the cheapest company in the

large industrial complex.

But why

are investors so skeptical – because of the recalls last year?

– Last year they had the recalls, which was a complete disaster. The issue has

been mired in controversy, but once it gets put in the rearview mirror value

investors will start to show up. The Department of Justice hasn’t fined them

yet. Whether that fine is 1, 2 billion or 3 billion, doesn’t matter since GM

has 30 billion in unrestricted cash. The fine is not relevant. What is relevant

is that the fine gets announced and put behind them. I think that will be a

catalyst going forward. I also expect GM to raise their dividend in the next

few days. That’s another potential catalyst.

What’s

the stock worth in your opinion?

– At least 45 dollars.

You

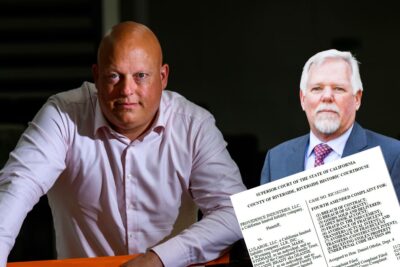

changed the subject of your speech from Argentina and Japan to U.S. pharma.

What’s the case in U.S. pharma?

– The pharma companies have been able to raise prices on drugs because of a law

passed in 2003 in the U.S. that disabled Medicare’s ability to negotiate price.

So the largest drug buyer in the world is not allowed to negotiate drug prices

with the drug companies. Whatever the drug companies say, Medicare pays. That

is difficult to believe, and I think it’s all going to change over the next

couple of years.

Why will

it change?

– Congress passed a law that went into effect in late 2012 that has been phased

in during 2013, called American Invents Act. That law provides an

administrative hearing in the U.S. patent office that allows intellectual

property to be challenged. And that will be more and more common in the coming

two years. That will bring to light the abuses that the U.S. pharma industry

has been engaged in, in maintaining monopolistic pricing power.

You’ve

been bearish on European banks, saying they need more capital. Recently

Santander announced that they need 7,5 billion euros in fresh capital. Do you

see more of that coming?

– I do. I realize there is a double counting in assets. They don’t net the

derivatives on their books, so it’s hard to compare U.S. bank assets with

European bank assets. But the European banks still need a lot more equity. And

if Russia continues to go south there is the handful of European banks that

have lent a lot to Russian companies. I wouldn’t own European banks until they

get recapped.

What

about Russian banks?

– Sberbank is probably the best bank in the world. It trades at maybe 60 per

cent of book value, has 600 basis points net interest margin and the Russian

central bank owns half of it. I don’t know where else you would put your money

if you’re in Russia. That’s where I would put it. It’s the greatest bank in the

world – we love it. But we don’t own it because we are too afraid of what might

happen next. Who knows what Putin’s next move is going to be? The situation is

too tenuous and I don’t think Putin is completely rational. He is clearly an

empire builder, but he is very calculating. I’m just not willing to take that

risk.

After the

oil price crash – are you snapping up any bargains?

– I think there are bargains in credit, but I don’t think there are bargains in

equity yet. This is based upon my view of where the price goes. If global GDP

grows at 3-3,5 per cent a year, that’s incremental oil demand of about 1,1

million barrels a day and we’re about 800 000 barrels a day in surplus today.

In 2-2,5 years it gets closer to some semblance of balance. And balance doesn’t

mean 100 dollars, it means a little bit higher from here. We will see some

restructurings in the higher levered companies, which will be cleansing.

Do you

have a role model or an investor you look up to?

– As I was studying this business a decade ago I read every book that George

Soros had written. Since then I’ve become friends with him. He’s one of the

best that’s ever lived, doing what we do.

Note: Affärsvärlden, published since 1901, is Sweden’s leading business weekly.

Kommentera artikeln

I samarbete med Ifrågasätt Media Sverige AB (”Ifrågasätt”) erbjuder Afv möjlighet för läsare att kommentera artiklar. Det är alltså Ifrågasätt som driver och ansvarar för kommentarsfunktionen. Afv granskar inte kommentarerna i förväg och kommentarerna omfattas inte av Affärsvärldens utgivaransvar. Ifrågasätts användarvillkor gäller.

Grundreglerna är:

- Håll dig till ämnet

- Håll en respektfull god ton

Såväl Ifrågasätt som Afv har rätt att radera kommentarer som inte uppfyller villkoren.